Timeline

1 year

My Role

Visual Design on a team of Two Designers

Deliverables

Component Libraries, User Interviews, High Fidelity Designs

Project Summary

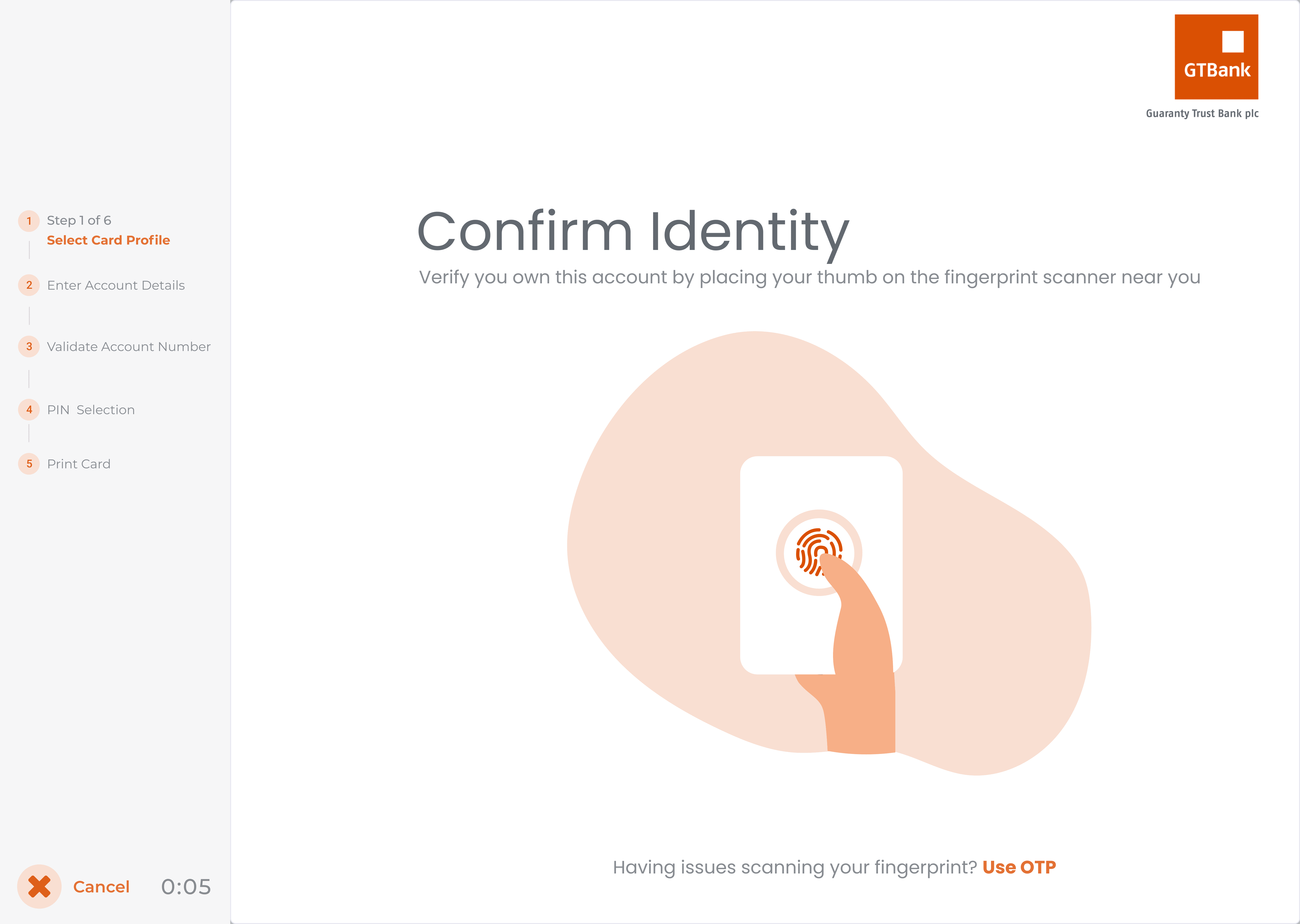

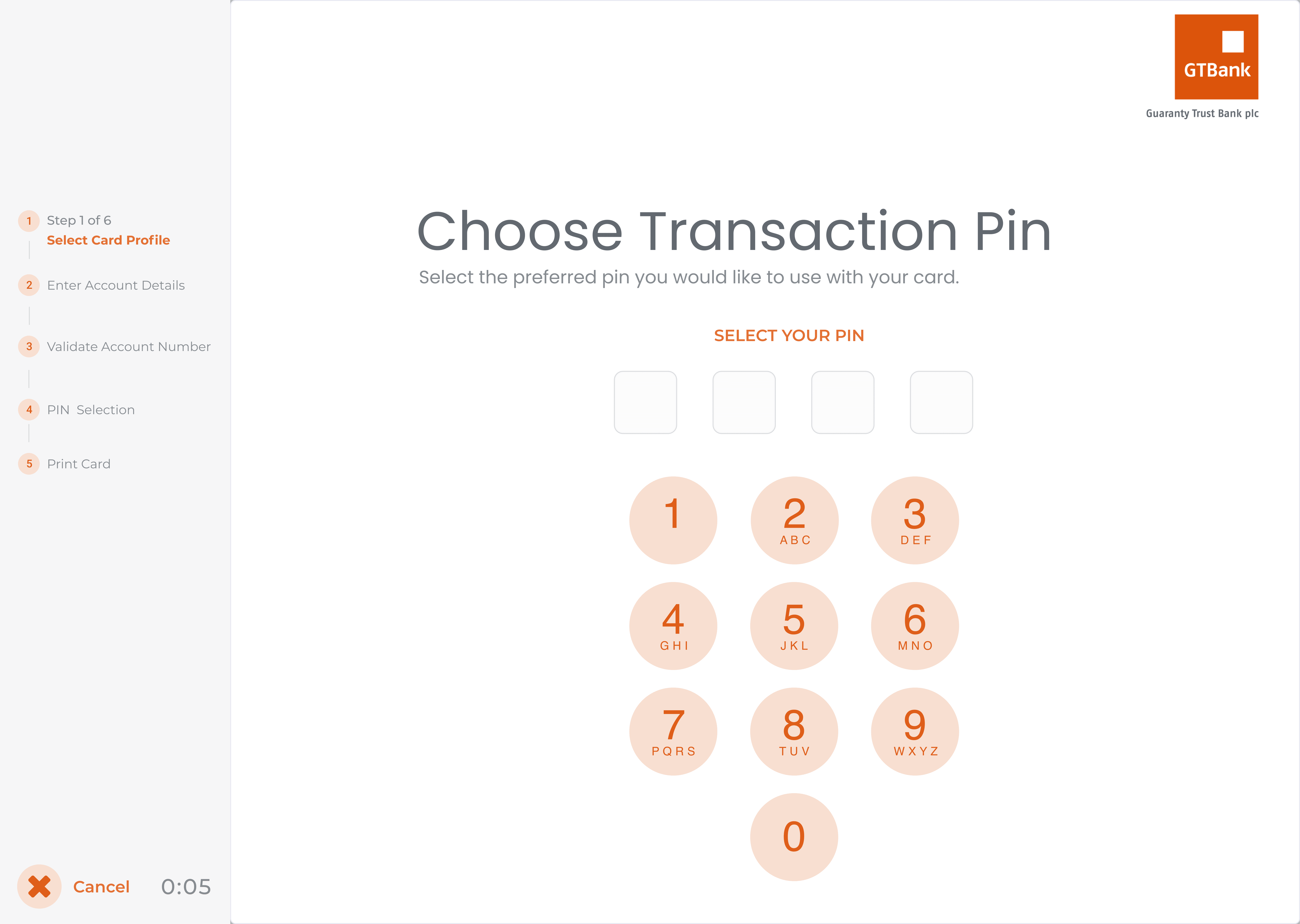

The GTBank project focused on designing an innovative self-service ATM card issuance system to reduce branch congestion and improve customer experience. The new system allowed customers to receive ATM cards within 10 minutes at any branch or kiosk. I collaborated with a small team to create an intuitive user interface that achieved an 85% acceptance rate, improving operational efficiency. The system's streamlined design reduced wait times and enhanced the overall customer journey, significantly easing in-branch traffic during peak times.

What are the problems?

GTBank’s ATM card issuance process was plagued by long customer wait times, leading to branch congestion and inefficiencies. Customers often experienced frustration due to the manual, labor-intensive process of issuing cards, which also strained branch resources, especially during peak hours.

Approach & Design Process

To address these challenges, we designed a self-service ATM card issuance system that allowed customers to receive their cards within 10 minutes. After analyzing user pain points, we created intuitive wireframes and prototypes to streamline the card issuance process. Following multiple rounds of user testing and iteration, the final system significantly reduced wait times, achieving an 85% customer adoption rate and easing branch congestion.. Below is an embedded Figma file, showcasing the key stages of the design process.

Key Metrics

Design Guide

The modular design system for this project allowed for faster updates and easier maintenance as the product scaled by creating reusable components such as buttons, input fields, and layouts. Each component was standardized, ensuring that design changes could be made centrally and applied across the platform, reducing the need for redesigns from scratch.

Conclusion

The project's success was measured through key metrics aligned with the initial goals:

Reduced ATM Card Issuance Time: The primary objective was to reduce card issuance time to under ten minutes. Analyzing user data can determine if this target was achieved.

Increased Revenue: While not directly addressed in the initial objectives, an increase in card issuance could potentially lead to higher revenue for the bank.

Increased Card Issuance: The observed 40% increase in card issuance suggests the application successfully addressed customer pain points and encouraged card use.

Reduced Branch Queues: The 60% reduction in branch queues demonstrates the application's effectiveness in minimizing physical branch visits.